Binary Option Deposit Kecil

Trading derivatives is one of the most popular ways to invest in the stock market, and with good reason: it can be a very profitable way to make money, since you don’t need to own the underlying asset to make a profit.

1

- Jinia Shawdagor Author

- Hannah Jones Editor

- 10 min read -->

- Published: December 05, 2022

- Views: 1525

- What Are Binary Options?

- What are Binary Options Robots?

- Main Types of Binary Options Robots

- Best Binary Options Robots in the US

- How Binary Options Robots Work

- FAQs About Binary Option Robots

- What Are Binary Options?

- What are Binary Options Robots?

- Main Types of Binary Options Robots

- Best Binary Options Robots in the US

- How Binary Options Robots Work

- FAQs About Binary Option Robots

With Binary options, traders and investors get high returns with relatively low risk, which is why most people are drawn to this type of trading. But as with all investments, there are risks involved, and you need to be capable of conducting sufficient market analysis using technical tools that will help you make informed decisions about your bets.

This is where binary options robots can work best for you binary options es seguro . I started using robots after losing a lot of money on the stock market early in my trading journey . I was constantly making bad decisions, and my broker wasn’t giving me any good advice, so I decided to find a solution that would automate my trades.However, not all bots are created equal, and you must do your due diligence before investing in one. If you find a reputable binary options robot, it can be a great way to make money while you sleep, or at least have a leg up when it comes to trading.

In this article, we will look at the best binary options robots for auto trading in the US. We will also look at how they work, and how to choose the best auto trading software for binary options. But first, a primer on what binary options trading entails.

Introduction Binary Option Deposit Kecil

Binary options are a type of derivative trading where you bet on whether the asset will take on a bullish or bearish price movement. If you are correct, you make a profit; if you are wrong, you lose your investment.

The underlying asset can be anything – from a stock, commodity, or currency pair to a cryptocurrency. You can bet on its price movements over a certain period of time. This period could be as short as 60 seconds or as long as a month. When you trade binary options, you are essentially gambling on the underlying asset’s price movement.

And, like all gambling, there is a risk involved, and you can lose money if you are not careful. The good news is that there are ways to mitigate your risks and increase your chances of making a profit. One way to do this is by using a binary options robot.

Further reading- TD Ameritrade review 2024: should you sign up with this broker?

- Ally Invest 2024: Commission-Free – A Feature Trade-Off?

- FreshForex Review: Is FreshForex Ideal for Forex and CFD Trading?

- Unbiased (2024) Review of IronFX Trading Platform

- FXCM Review - Best Forex Brokers

- Finrally 2024 Review: Your Binary Options Broker Quest

What are Binary Options Robots?

A binary options robot is a piece of software designed to automate the process of making trades. It uses complex algorithms and technical analysis to analyze the market and predict an asset’s price movements.

Automated binary options trading is suitable for novice traders looking to save unnecessary time and effort as they learn the ropes and figure out how to make profitable moves.

It is also suitable for experienced traders who want to free up their time, especially if they are working with multiple financial instruments. In essence, a binary options robot will save the trader from the grind of constantly monitoring the market and making trades manually.

Another benefit of using a binary options robot is that it helps the trader avoid making emotional trades, which can often lead to losses. The best auto trading software for binary options will perform all the complex analytics for you and generate trading signals based on market conditions.

All you need to do is follow the instructions provided by the software and place your trade accordingly. The trader can set up parameters, and the robot will work to make Put and Call options based on the criteria set by the trader. Binary options robots are a relatively new innovation; however, several different auto trading platforms are available for binary options.

Further reading- BEST ONLINE EARNING APPS IN PAKISTAN IN 2024 (AUTHENTIC WAYS)

- CLM Forex (Core Liquidity Markets) - Broker Review

- Etoro Review: A CFD and Forex Broker with a Social Trading Opportunity

- 10TRADEFX REVIEW 2023: IS IT WORTH IT?

- Investors take Forex platform ROFX and its founders to court

- What Is a Forex Cent Account? Learn the Basics!

Main Types of Binary Options Robots

Binary options trading bots can be categorized into two main types.

- Fully Automated Trading Robots: These trading robots will do all the work for you. All you need to do is set your parameters and let the robot trade on your behalf. These robots are suitable for experienced traders who want to take a hands-off approach to trading.

- Semi-Automated Trading Robots: These robots will provide you with trading signals which you can choose to follow or not. These robots are suitable for traders who want more control over their trades but still want some help with complex analytics.

- Copy Trading Robots: These are the robots that will copy the trades of other successful traders. It is a good option for novice traders who want to learn from more experienced traders.

There are also both paid and unpaid trading software choices available for binary options. Paid software usually has more features and provides better customer support than free software. However, free software can still be helpful for traders who want to test out different trading strategies without risking any money.

Further reading- 110 Trading Quotes to Set You on the Road to Success

- What Is Swap (XWP) And Why You Should Invest In It

- Introduction to Smooth Love Potion (SLP) Crypto, and How to Use It

- Finrally 2024 Review: Your Binary Options Broker Quest

- MetaTrader 4 Unleashed: Expert and Novice-Friendly Trading

- Trader's diary. Why and for what you need it?

Best Binary Options Robots in the US

Picking the best auto trading software in 2023 can be daunting, given the many scams and dubious companies in the industry.

Don’t worry, we’ve done the hard work for you: we compiled a list of the best binary options robots in the US based on several criteria, such as the type of software, available features, and the pricing models that come with each binary options robot.

Nadex

The Nadex trading bot from Nadex Exchange is a paid binary options trading robot that features built-in capital management strategies designed with neural networks to help traders earn a profit on their Binary Options trading.

Once the software is installed on your PC, it will run automatically and generate market signals and trade directions that can be executed on your Nadex Exchange account.

Nadex is one of the leading binary options exchanges in the US and offers a variety of assets, including commodities, currency pairs, stock indices, and crypto. Some of the features that distinguish Nadex as an excellent trading bot include automated trade execution, market analysis tools, built-in deposit protection, and 24/7 customer support.

Binary Bot

Binary Bot from Binary.com is a semi-automated binary options trading software with an extensive range of customization options. This free auto trading software lets you create and implement automated trading strategies.

The software also provides multiple technical indicators, charting tools, and market analysis features from Binary.com. Some of the top features of the Binary Bot software include the ability to backtest your trading strategies, create custom indicators, and customize various options.

OptionRobot

Option Robot is another free automated binary options trading software that is designed to integrate seamlessly with a variety of online brokers such as Binex, IQ Option, Binary.com, and more. It is a web-based software that features an extensive range of customization options.

Some useful features that come with Option Robot include the ability to trade on multiple assets simultaneously and create custom trading indicators. This bot can also be used with a wide range of trading strategies, such as the Martingale system and Fibonacci System, to mention a few. OptionRobot also comes with a mobile app and a demo account.

DAXrobot

DAXrobot is an unpaid automated binary options trading software that is specifically designed with a variety of automated trading strategies for the DAXbase broker. This semi-automated robot lets you choose your own indicators and parameters to work with.

Several deposit methods are supported, which is favorable amongst DAXbase’s customers. Although some users online complain about the robot being slow, most of the reviews nevertheless mention its intuitive user interface.

Pocket Option

Pocket Option receives high ratings from online reviews, and for a good reason. This binary options trading bot adheres to AML and KYC. Additionally, the software is backed by a regulated company.

Some of Pocket Option’s best features include 24/7 customer support, social or copy trading, as well as useful market indicators and signals. The platform also features a demo account and bonuses that most novice traders will appreciate.

Further reading- Volume Based Trading Techniques (Volume Indicators)

- How to Make a Sideways Trend Work for You: Trading Strategy

- FreshForex Review: Is FreshForex Ideal for Forex and CFD Trading?

- What is Siacoin? The Full Guide: Storage & Mining

- The Complete (2024) E*Trade Review: Online Trading Simplified

- Swissquote review 2024: should you sign up with this broker?

How Binary Options Robots Work

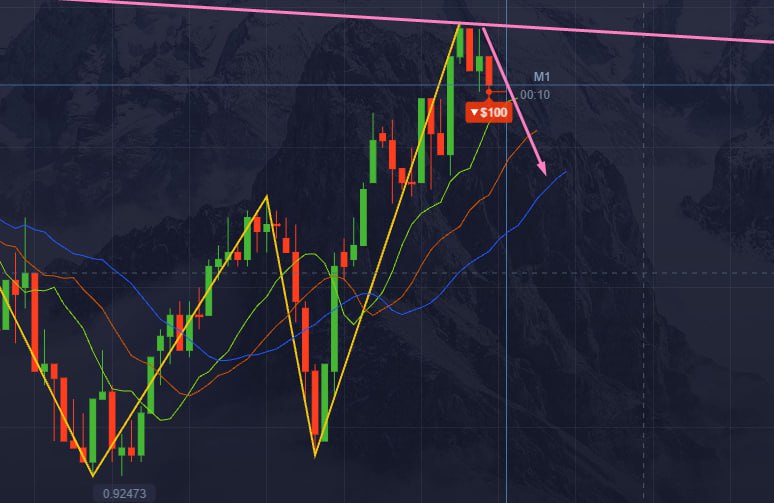

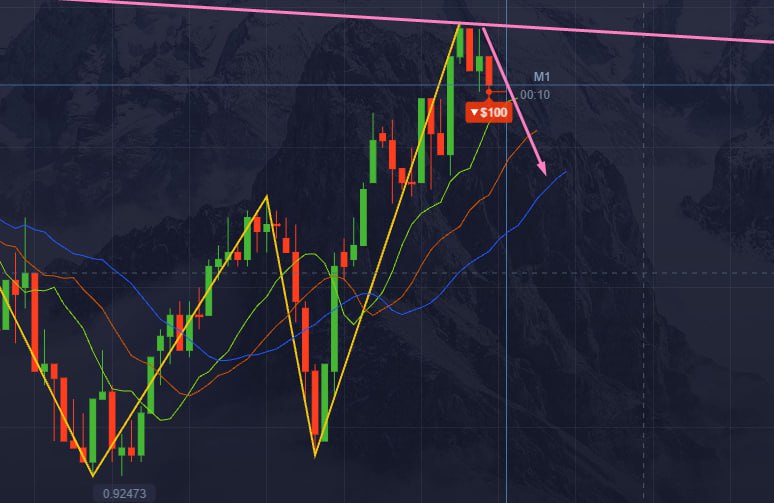

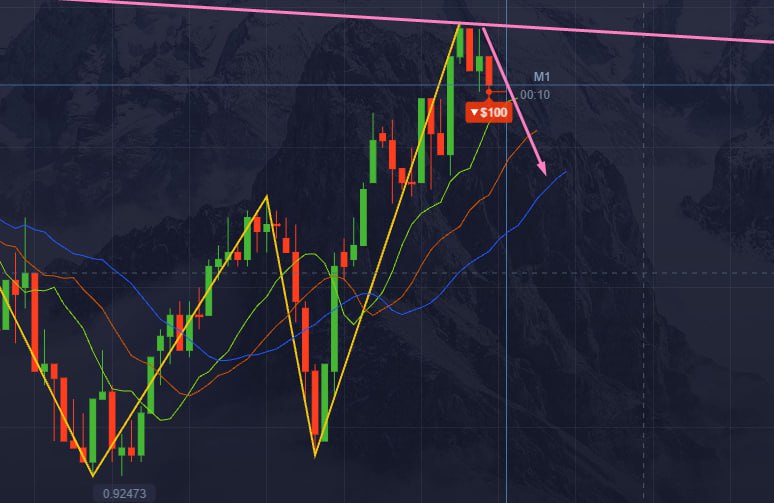

Binary options robots simplify the process with algorithms designed to recognize market patterns, trends, and price movements.

When such market conditions are identified, the software will generate trade signals that can be executed on your account. The best binary options robots have a success rate of around 80% and are designed to work with all sorts of assets, including stock indices, commodities, currency pairs, and cryptocurrencies.

When choosing a binary options robot, it is important to choose one that is backed by a regulated company and features a user-friendly interface. Here is a breakdown of some top considerations while choosing a binary options robot:

Ease of Use

The best auto trading software for binary options should be intuitive for the user. In addition to features which enhance the experience, the software should include customization options to allow you to tweak the software to your liking. The last thing you want is to sign up for software only to find it is too difficult to use or understand.

Range of Assets

The best binary options robots should have a range of assets that you can trade with. This includes major currency pairs, stock indices, commodities, and cryptocurrencies. The more assets that are supported by the software, the better your chances of making a profit.

Relevant Features

Some of the most important features to expect from the best binary options robot include access to indicators like the RSI (Relative Strength Index), MACD, and STOCH. The software should also come with a mobile app to allow you to trade on the go.

Bonuses and Promotions

Some binary options robots offer bonuses and promotions to encourage traders to sign up for their services. These can include deposit bonuses, demo accounts, and even risk-free trades. However, some brokers only offer bonuses to trap unsuspecting traders. It is important to read the fine print before signing up for any bonus or promotion.

Customer Support

The best binary options robots will have excellent customer support. This includes 24/7 support, multiple channels of communication, and several languages supported. It is also important to choose software backed by a regulated company. This provides an extra layer of safety for your money.

Fees

As mentioned, some binary options robots are free while others are available for purchase. The best software will have all the features you need while also being affordable. Some binary options robots come with a monthly subscription fee. However, these usually come with a free trial period, allowing you to test out the software before committing to it.

Further reading- Gerchik & Co - Review of the Well-Known Forex Brokers

- CLM Forex (Core Liquidity Markets) - Broker Review

- Option Robot Review - The Best Auto Binary Trading System?

- eOption review 2024: should you sign up with this broker?

- IC Markets Broker Overview

- Swissquote review 2024: should you sign up with this broker?

FAQs About Binary Option Robots

Are Binary Options Robots completely reliable?

Binary options robots are not 100% foolproof, but they can be a valuable tool for binary options traders. The best software will have a high success rate and will come with all the features you need to be successful in trading binary options. It is important to remember that no software can guarantee perfect accuracy – there is always a risk of losing money when trading binary options.

Are Binary Options Robots legal?

Yes, binary options robots are legal in the United States. However, it is important to choose software from a regulated company.

Can I use a Binary Options Robot on my mobile?

Yes, some binary options robots come with mobile apps that allow you to trade on the go.

Do I need to be an expert to use a Binary Options Robot?

No, you don’t need to be an expert to use a binary options robot. The best software will be easy to use and understand.

Further reading- Interactive Brokers Review: A Globally-Regulated Discount Broker

- Trader's diary. Why and for what you need it?

- The Story Behind the MBA Forex Scam and Closure

- ZENITH TRADING STRATEGY FOR BINARY OPTIONS

- How to Make a Sideways Trend Work for You: Trading Strategy

- Markets.com 2024: Unveiling the Ultimate User-Friendly Platform?