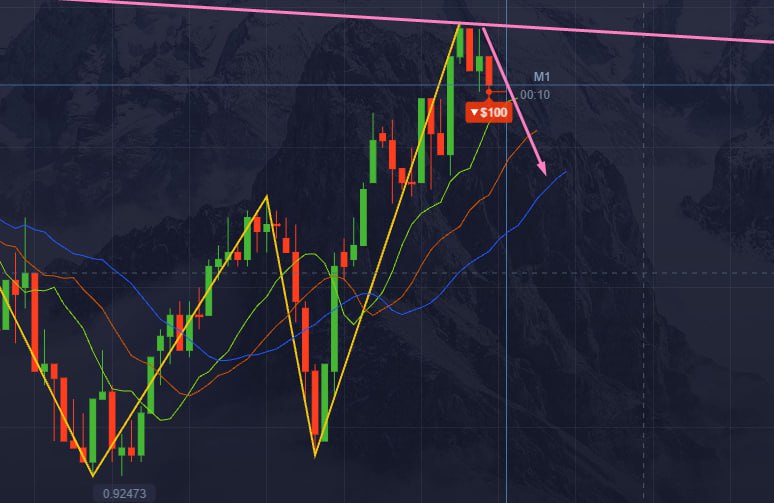

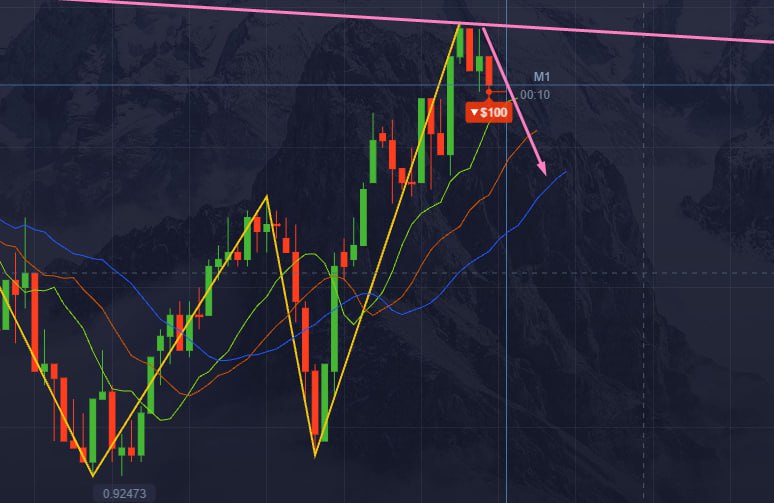

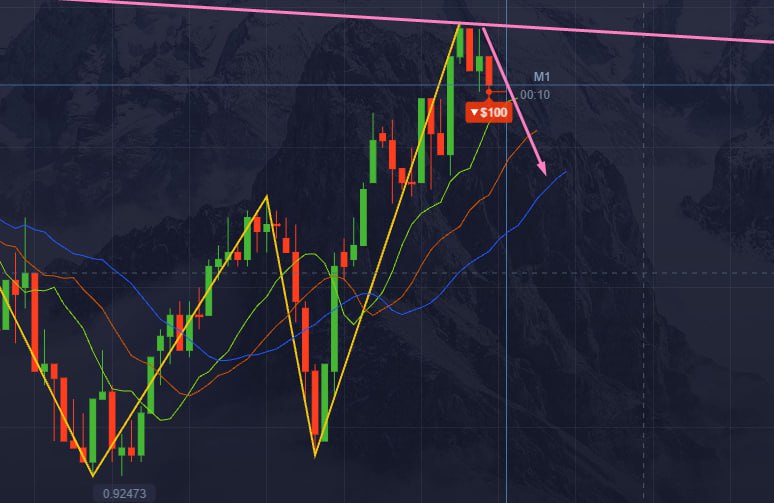

Binary Options 5 Second Strategy

Some traders trade from their desktop, some trade on the go, and HFX provides a platform for all of them binary trading graph . Take a look at the platforms we provide and find the perfect one for you!1

HFX MT4 Terminal

The MetaTrader 4 (MT4) desktop platform is one of the most popular in the world, and we provide it for free to every client!

HFX Android

HFX Android platform ensures you can trade via your Android phone or tablet on the go.

HFX iPhone Trader

Our advanced MT4 iPhone platform means your trades can go with you wherever you go.

HFX iPad Trader

Advanced functionality means this iPad trader offers seamless integration and a state-of-the-art trading solution.

HFX WebTerminal

Easy access web-trading! Login from your favorite browser and trade. No download necessary.

Partner with HFX

Introduction Binary Options 5 Second Strategy

About

- About HFX

- Regulation and Licence

- Security of Funds

- Legal Documentation

Products

Platforms

- Download the HFX MT4

- HFX Android

- HFX iPhone Trader

- HFX iPad Trader

Tools

- Trading Calculators

- myHFX Client Area

Partners

- Become a Partner

- About HFX Partners

- Partners Tools

- FAQs

Legal: PT. HFX Internasional Berjangka is authorised and regulated by the Commodity Futures Trading Supervisory Agency (BAPPEBTI) under licence number 877/BAPPEBTI/SI/1/2006.

The website is operated by PT. HFX Internasional Berjangka.

Risk Warning: Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary seek independent advice. Please read the full Risk Disclosure.

- Copyright © 2024 - All Rights Reserved