Binary Options Create Account

In this section of the site we’ll be looking at the most trusted binary options brokers in the market binary auto trading bot . We have undertaken in depth research in order to bring you our recommended brokers reviews . We are always pleased to get feedback on the various brokers, so please share your experiences with us.1

Introduction Binary Options Create Account

| Broker | Min Deposit | Rating | More |

|---|---|---|---|

| $ 10 | ★★★★★ | Sign Up Review | |

| € 10 | ★★★★★ | Sign Up Review | |

| $ 250 | ★★★★★ | Sign Up Review | |

| $ 250 | ★★★★★ | Sign Up Review | |

| $ 250 | ★★★ | Sign Up Review |

Breakdown of a Binary Options Review

- Broker’s Background

- Regulatory Oversight

- Trading Platform

- Trade Types

- Account Types

- Deposits & Withdrawals

- Customer Support

Broker’s Background

Usually appearing as the review introduction, this section will normally include a little about the history of the broker, the year it was established and information on who owns the company. The location of the broker’s headquarter is also included in this section. This information can reveal critical information about the broker.

For example, the year when the broker was established will indicate if this is a new broker or one which has been around for a while . A broker that has been around for a while is normally more trustworthy than a newly established broker binary option spread trading . In addition, it is also a good way to spot a legitimate broker from a scam broker . Legitimate binary options brokers tend to reveal more about their corporate background whereas scam brokers tend to be evasive and will try to provide as little information about themselves as they can get away with.Regulatory Oversight

For most binary options brokers, this section is one of the most important of their review. This is because a broker is that is regulated is more likely to be trusted than an unregulated one. When evaluating the broker’s regulatory status, it is also important to note which regulatory body the broker is regulated with. Not all regulatory agencies are created equal. For example, a license from the Cyprus Securities Exchange Commission (CySEC) carries more weight than a license obtained from the British Virgin Islands Financial Services Commission. This is because some regulatory agencies have more resources dedicated to ensuring that the brokers under their jurisdictions comply with all the regulatory requirements.

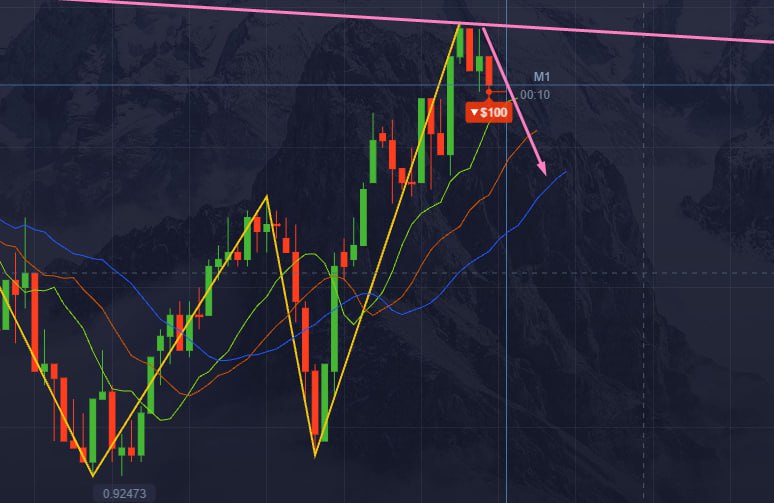

Trading Platform

In the binary options trading industry, you are likely to come across two main types of trading platforms, proprietary trading platforms and white labelled trading platforms.

White labels/Generic

White labelled trading platforms are generic trading platforms supplied by third party online trading solutions providers. This is the main reason why many of the trading platforms adopted by binary options brokers look so similar. Apart from some minor differences in the colour and design of the user interface, the platforms are essentially the same. For white labelled trading platforms, the leader is the SpotOption trading platform which is adopted by more than 80% of the brokers in the industry. Most brokers tend to use white labelled trading platforms as it helps them to save on development and support costs

Proprietary

The second type of trading platform that you will come across more occasionally is the proprietary trading platform. These platforms are developed in house to meet the specific needs of the brokers. As there are additional development costs involved, most brokers tend to shy away from having their own proprietary platforms.

“What we can gather from this section of the review is that if the broker is willing to expend resources to develop its own platform, then you can infer that this broker is likely to be more professional and dedicated to its long term business objective. In other words, a broker with a proprietary trading platform is less likely to be a scam broker”

Trade Types

The section on the trade types will reveal how many types of options contracts the broker‘s trading platform is able to support. Different types of trading platforms will support different types of options contracts. Most trading platforms will be able to support at least 4 to 5 different types of options contracts. Currently, the trading platform that can support the most number of option contracts is the SpotOption powered trading platform. Depending on the configurations which the broker has requested from SpotOption, you may be able to choose up to 8 different types of option contracts namely:

- Classic Call/Put Binaries

- Derivatives Options

- FX/CFD

- Ladder options

- Long Term Binaries

- One Touch options

- Pairs

- Short Term Binaries

Account Types

Binary options brokers generally tend to offer their clients a choice of several types of trading accounts. These trading accounts differ in the minimum deposit requirements, the benefits that they offer and sometimes the percentage returns. The lower level trading accounts usually require a smaller amount of minimum initial deposit. However, they will have limited access to other benefits such as trading education, a dedicated account manager and lower bonuses as well. Free withdrawals are usually limited to once a month. Any subsequent withdrawals made during the same calendar month will usually incur a service fee.

For higher end trading accounts like the premium or VIP trading account, they usually get extra benefits such as unlimited free withdrawals as well as expedited withdrawals. The percentage returns on these accounts are usually higher by an additional 4% to 5%. The major drawbacks of these trading accounts are the fact that you are subjected to a higher minimum deposit requirement.

Deposits & Withdrawals

To make their clients trading experience as pleasant as possible, most binary options brokers offer a selection of fund transfer methods. These methods typically fall into 3 main categories:

- Credit/Debit cards

- eWallets

- Bank Wire transfer

The most convenient and secured method of transferring funds will be by credit/debit cards. This is due to the fact credit payment providers require vendors to adopt a high level of security. It is also convenient due to the fact that your credit card is usually linked directly to your bank account. This means funds can be transferred almost immediately from your bank account to your credit card. This same goes for withdrawals made through credit cards.

Depending on the eWallet used, eWallets are usually the fastest and cheapest way to transfer funds online. However, it should be noted that some eWallets are not available for traders in certain countries to the local regulatory requirements.

“Bank wire transfers are the most expensive way of transferring funds to and from your trading account. It also takes the longest for the broker to receive the funds as they are processed through the banks first. This option is typically used only when the above mentioned methods are not available to traders”

Apart from evaluating the various methods provided by the broker, it is also important to note the conditions if any are attached to the deposit and withdrawal of funds. For example, some brokers may require that you withdraw a minimum amount. Hence be sure to read all the terms and conditions before agreeing to any of them.

Customer Support

The third most important aspect of a broker’s review after its regulatory status and trading platform is the customer support service. The binary options market trades on a 24 hours basis 7 days a week. What this means is that problems can crop up at any time and not just during office hours. With this in mind, you have to take note of the operation hours of the customer support service. You want to be able to get assistance whenever you need it and not just during office hours.

Furthermore, you want to ensure that you are able to reach the customer support service through several different methods and not just through methods that rely on the internet. Bear in mind that if for whatever reason you lose your internet connectivity, you still want to be able to get in touch with your broker. This is where you can really see the different between a good broker and a bad broker.

“A good broker will try its best to ensure that it is able to resolve any problem that you may encounter as quickly as possible. A bad broker on the other hand is one that tries to make itself as scarce as possible whenever there are issues. If a broker does not provide live chat and telephone support, then you should be wary of the broker in question. “

Binary Options Broker Scams

So far what we have discussed will help you differentiate between a good broker and a bad broker. But what about scam brokers? How can you tell if a broker is a legitimate broker or a scam broker? Well, there are a few telltale signs which you can look out for which can be an indication that the broker in question is mostly likely a scam broker. Binary options broker scams may be perpetuated by different parties but their techniques are all similar. For example, they tend to make promises which they can never keep. If a broker guarantees that you will make a profit by investing with them, then the broker is almost definitely a scam broker. This is because in financial trading, nobody can predict the results.

“Another scam which some brokers use is by withholding your money because you fail to satisfy the bonus withdrawal conditions. While it is your responsibility to read all the terms and conditions, it is still unethical for the broker to withhold your money because of the failure to fulfil the bonus withdrawal conditions. This is the main reason why regulatory agency such as CySEC has banned binary options brokers from offering trading bonuses with conditions attached.”

Finally, watch out for brokers that do not provide any information as to their corporate background or location. Such behaviours are not typical of a legitimate broker that wants to establish a long term business relationship with its clients. You have to remember that the broker at the other end of the internet connection is just a faceless entity. So if you would not randomly give your money to a stranger that you meet on the street, why should you do the same for a broker that is so secretive about its owner/s and location?

Conclusion

Being able to make a trade successfully is only part of the journey to being a successful binary options trader. You also have to ensure that you are getting the best terms and product from your broker. It is important that you evaluate a broker carefully before committing yourself. The best way of going about this and without having to risk your money is by studying the reviews of the broker in question.

In addition, by checking out the reviews of the binary options brokers that you are interested in, you will be able to save money, time and effort in your search for the best binary options brokers. Hence, we strongly encourage you to conduct your due diligence and read the reviews that we have compiled so you can make a better informed decision when selecting your binary options broker.

Most visited Forex reviews in 2024

logo Risk Disclaimer: All the information you find on Bestfxbrokers.com is provided for educational purposes and should not be considered financial advice. Bestfxbrokers.com is neither authorized nor licensed to provide financial advice, advice on investing or advice on related matters. We'll not accept liability for any losses incurred by relying either directly or indirectly on the information provided on this website.