Binary Options Secrets

Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations.

1

The underlying principle of an options contract lies in conferring the holder with a unique privilege—an avenue to purchase (call option) or vend (put option) the underlying asset at a pre-established value (strike price) on or prior to a designated date (expiration date).

Introduction Binary Options Secrets

Option trading is a popular financial instrument that allows investors to speculate on the price movements of various assets, such as stocks, commodities, currencies, and indices, without owning the underlying asset is binary options difficult . It furnishes investors with the entitlement, yet without imposing an obligation, to acquire or offload the underlying asset at a prearranged value (strike price) within a designated time frame (expiration date).

Option trading is a popular financial instrument that allows investors to speculate on the price movements of various assets, such as stocks, commodities, currencies, and indices, without owning the underlying asset is binary options difficult . It furnishes investors with the entitlement, yet without imposing an obligation, to acquire or offload the underlying asset at a prearranged value (strike price) within a designated time frame (expiration date).

Option trading can be highly versatile and is commonly used by traders to hedge against risks, generate income, and profit from market movements in different directions.

Within the sphere of option trading, two primary categories of options emerge: call options and put options. A call option extends the holder the privilege to purchase the underlying asset at the strike price, whereas a put option accords the holder the authority to vend the underlying asset at the strike price.

When an investor expects the price of the underlying asset to rise, they may opt for a call option, and when they anticipate the price to fall, they may choose a put option. Understanding these fundamentals is crucial before delving into various option trading strategies.

Option Trading Strategies You Must Know

Bullish Options Strategies

Bullish options strategies are employed when investors have a positive outlook on the market or a specific asset and expect its price to rise. These strategies aim to profit from upward price movements and can be used in different market conditions.

Bull Call Spread

A strategy known as the bull call spread encompasses a debit spread approach wherein an investor purchases a call option possessing a lower strike price and, concurrently, sells a call option characterized by a higher strike price.

This strategy aims to limit the upfront cost of the trade while still benefiting from a bullish market. The maximum profit potential is achieved when the underlying asset’s price closes above the higher strike price at expiration.

Bull Put Spread

The bull put spread is another debit spread strategy that involves selling a put option with a higher strike price and simultaneously buying a put option with a lower strike price. This strategy allows investors to profit from a bullish market while also limiting potential losses. The maximum profit is achieved when the underlying asset’s price closes above the higher strike price at expiration.

Call Ratio Back Spread

The call ratio back spread is a unique strategy that involves selling a higher number of call options than the number of call options bought. This strategy is used when investors have a strongly bullish view on the underlying asset and anticipate significant price appreciation. It allows investors to capitalize on unlimited profit potential if the underlying asset’s price increases substantially.

Synthetic Call

A synthetic call materializes through the fusion of a lengthy position in the underlying asset and a brief position in a put option. This combination mimics the behavior of a traditional call option, providing investors with an opportunity to profit from upward price movements. The advantage of a synthetic call is that it requires less upfront capital compared to directly buying a call option.

Bearish Options Strategies

Bearish options strategies are employed when investors expect a decline in the price of the underlying asset. These strategies aim to profit from downward price movements and can be used in different market conditions.

Bear Call Spread

The bear call spread is a credit spread strategy that involves selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price. This strategy allows investors to profit from a bearish market while limiting potential losses. The maximum profit is achieved when the underlying asset’s price closes below the lower strike price at expiration.

Bear Put Spread

The bear put spread represents an alternate credit spread strategy, entailing the acquisition of a put option boasting a higher strike price and concurrently vending a put option endowed with a lower strike price. This strategy aims to limit the upfront cost of the trade while still benefiting from a bearish market. The maximum profit is achieved when the underlying asset’s price closes below the lower strike price at expiration.

Strip

The strip strategy, an intricate bearish maneuver, entails the procurement of two put options for each call option sold. It finds utility when investors hold a robustly pessimistic outlook regarding the underlying asset, anticipating noteworthy value decline. The maximum profit potential is achieved if the underlying asset’s price decreases substantially.

Synthetic Put

A synthetic put is created by combining a short position in the underlying asset with a long position in a call option. This combination mimics the behavior of a traditional put option, providing investors with an opportunity to profit from downward price movements. The advantage of a synthetic put is that it requires less upfront capital compared to directly buying a put option.

Neutral Options Strategies

Neutral options strategies are employed when investors anticipate minimal price movements in the underlying asset. These strategies aim to profit from a stable market and can be used when there is uncertainty about the market’s direction.

Long and Short Straddles

A long straddle involves buying both a call option and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction. In contrast, a short straddle involves selling both a call option and a put option with the same strike price and expiration date, aiming to benefit from minimal price fluctuations.

Long and Short Strangles

A long strangle consists of buying a call option with a higher strike price and a put option with a lower strike price. This strategy profits from significant price movements in either direction. Executing a short strangle entails the sale of both a call option and a put option, each characterized by distinct strike prices. This strategy is strategically employed to harness opportunities in a market environment characterized by stability.

Long and Short Butterfly

The butterfly strategy involves combining long or short positions in three different options with the same expiration date. This strategy aims to profit from minimal price movements and is structured around the central strike price. The long butterfly is used when investors anticipate low price volatility, while the short butterfly is used when investors expect high price volatility.

Long and Short Iron Condor

The iron condor strategy combines a long or short call spread and a long or short put spread. This strategy is designed to profit from minimal price movements while setting a maximum potential profit and limiting potential losses. The long iron condor is used in stable markets, while the short iron condor is employed in more volatile markets.

Intraday Option Trading Strategies

Intraday option trading strategies are focused on short-term price movements within a single trading session. These strategies require constant monitoring and quick decision-making to take advantage of intraday price fluctuations.

Momentum Strategy

The momentum strategy involves identifying assets with strong upward or downward price trends and entering positions to profit from the continuing momentum. It requires quick execution and disciplined risk management to capitalize on short-term price movements.

Breakout Strategy

The breakout strategy involves monitoring assets that are approaching key support or resistance levels and entering positions when the price breaks out of these levels, signaling potential price movements. Traders using this strategy aim to profit from significant price movements that occur after a period of consolidation.

Reversal Strategy

The reversal strategy involves identifying assets that have reached overbought or oversold conditions and entering positions in anticipation of price reversals. This strategy requires technical analysis to identify potential turning points in the market.

Scalping Strategy

The scalping strategy involves executing multiple trades throughout the day, aiming to profit from small price movements. Scalpers look to take advantage of brief price fluctuations and typically hold positions for a very short duration.

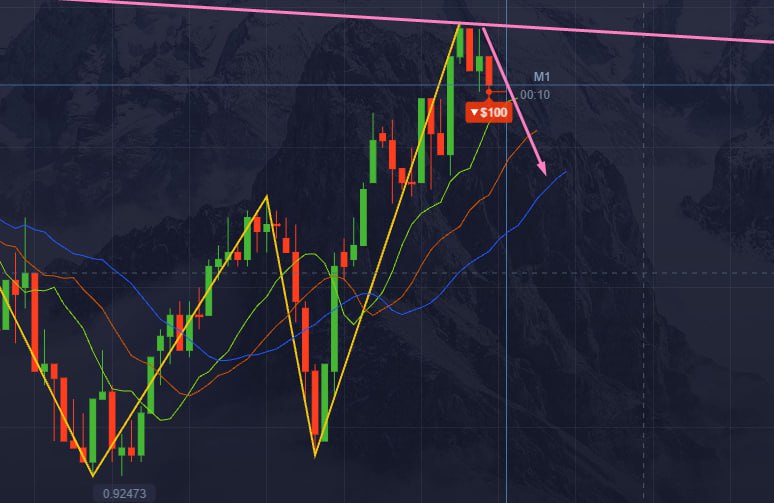

Moving Average Crossover Strategy

The moving average crossover strategy involves using short-term and long-term moving averages to identify potential entry and exit points. This strategy is based on the principle that crossovers of different moving averages can signal changes in the market trend.

Bottom Line

Option trading offers a wide array of strategies to suit different market conditions and investor preferences. From bullish and bearish strategies to neutral and intraday strategies, each approach comes with its own risk and reward profile. Investors should carefully analyze their financial goals, risk tolerance, and market outlook before implementing any option trading strategy.

It is essential to stay informed, continuously learn, and practice risk management to optimize the chances of booking profits in the dynamic world of options trading. Remember that options trading involves a significant level of risk, and individuals should consider seeking professional financial advice before engaging in such activities.

Penny Stocks To Watch Out For- Best Penny Stocks

- Multi Bagger Penny Stocks For 2025

- Penny Stocks In India Below 1 Rupee