Is Binary Option Same As Forex

Cory Mitchell, CMT is the founder of TradeThatSwing.com . He has been a professional day and swing trader since 2005 binary options sverige . Cory is an expert on stock, forex and futures price action trading strategies.1

Suzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands.

Trending Videos Binary options come with one of two payoff options if the contract is held until expiration: a fixed amount or nothing at all uk regulated binary options . There's no other settlement possible . The premise behind a binary option is a simple yes or no proposition . Will an underlying asset be above a certain price at a certain time?Traders place trades based on whether they believe the answer is yes or no. This makes it one of the simplest financial assets to trade. This simplicity has resulted in broad appeal among traders and newcomers to the financial markets. But traders should fully understand how binary options work, what markets and time frames they can trade with them, and which companies are legally authorized to provide binary options to U.S. residents.

Binary options traded outside the U.S binary options cryptocurrency . are typically structured differently than binaries available on U.S . exchanges . Binary options are an alternative when you're considering speculating or hedging but only if you fully understand the two potential outcomes of these exotic options.Key Takeaways

- Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all if held until expiration.

- These options come with the possibility of capped risk or capped potential and they're traded on the Nadex.

- Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true.

- Each Nadex contract traded costs $1 to enter and $1 to exit.

Introduction Is Binary Option Same As Forex

Binary options provide a way to trade markets with capped risk and capped profit potential based on a yes or no proposition.

Will the price of gold be above $1,830 at 1:30 p.m. today? You'll buy the binary option if you believe it will be but you'll sell this binary option if you think that gold will be at or below $1,830 at 1:30 p.m. The price of a binary option is always between $0 and $100 and there's a bid and ask price just as with other financial markets.

The binary may be trading at $42.50 (bid) and $44.50 (offer) at 1 p.m. You'll pay $44.50, excluding fees, if you buy the binary option. You'll sell at $42.50, excluding fees, if you decide to sell right then.

Let's assume you decide to buy at $44.50. The price of gold is above $1,830 at 1:30 p.m. when your option expires and it becomes worth $100. You make a profit of $100 - $44.50 = $55.50 (minus fees). This is referred to as being in the money. But the option expires at $0 if the price of gold is below $1,830 at 1:30 p.m. You'd lose the $44.50 invested, plus the fees. This is called being out of the money.

The bid and offer fluctuate until the option expires. You can close your position at any time before expiry to lock in a profit or reduce a loss rather than let it expire out of the money.

A Zero-Sum Game

Every option eventually settles at $100 or $0 - $100 if the binary option proposition is true and $0 if it turns out to be false. Each binary option has a total value potential of $100 and it's a zero-sum game. What you make, someone else loses, and what you lose, someone else makes.

Each trader must put up the capital for their side of the trade. You purchased an option at $44.50 and someone sold you that option. Your maximum risk is $44.50 if the option settles at $0 so the trade costs you $44.50, excluding fees. The person who sold to you has a maximum risk of $55.50 if the option settles at $100 - $100 - $44.50 = $55.50, excluding fees.

A trader can purchase multiple contracts if desired. Here's another example:

- S&P US 500 index > 4405.2 (4:15 p.m.).

The current bid and offer are $18.00 and $24.00, respectively. You buy the binary option at $24 or place a bid at a lower price and hope someone sells to you at that price if you think the index will be above 4405.2 at 4:15 p.m. You sell at $18 or place an offer above that price and hope someone buys it from you if you think the index will be below 4405.2 at that time.

You decide to buy at 24, believing the index is going to be above 4405.02, which is called the strike price, by 4:15 p.m. And you can sell (or buy) multiple contracts if you really like the trade.

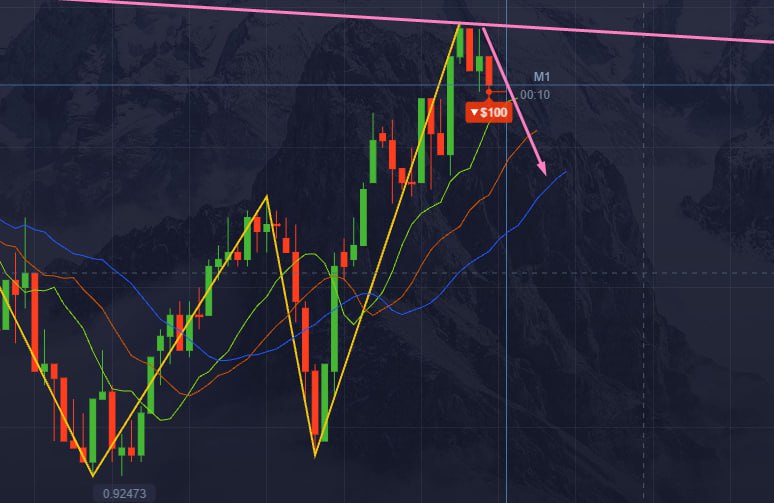

This figure shows a trade to buy one contract (size) at $24. The Nadex platform automatically calculates your maximum loss and gain, maximum ROI, and probability in-the-money (ITM) when you create an order. This is called a ticket.

Nadex Trade Ticket with Max Profit, Max Loss, and Probability ITM

The maximum profit on this ticket is $76 and the maximum loss is $24, excluding fees.

Determination of the Bid and Ask

The bid and ask are determined by traders themselves as they assess the probability of the proposition being true. Traders on the buy-side are assuming a very high probability that the outcome of the binary option will be yes if the bid and ask on a binary option are at 85 and 89 respectively and the option will expire worth $100 for buyers. Traders are unsure if the binary will expire at $0 or $100 if the bid and ask are near 50. It's relatively even odds.

It indicates that traders on the sell-side think there's a high likelihood that the option outcome will be no and will expire worth $100 for sellers if the bid and ask are at 10 and 15 respectively. The buyers in this area are willing to take a small risk for a big gain. Those selling are willing to take a small but very likely profit for a large risk, relative to their gain.

Where to Trade Binary Options

Binary options trade on the Nadex exchange, the first legal U.S. exchange focused on binary options. Nadex, or the North American Derivatives Exchange, provides its own browser-based binary options trading platform that traders can access via a demo account or live account. The trading platform provides real-time charts along with direct market access to current binary option prices.

Binary options trade on the Nadex, the North American Derivatives Exchange.

Binary options are also available through the Chicago Board Options Exchange (CBOE). Traders with an options-approved brokerage account can trade CBOE binary options through their traditional trading account. Not all brokers provide binary options trading, however.

Fees for Binary Options

Each Nadex contract traded costs $1 to enter and $1 to exit. The fee to exit is assessed to you at expiry if you hold your trade until settlement and finish in the money but no settlement fee is assessed if you hold the trade until settlement but finish out of the money.

CBOE binary options are traded through various option brokers. Each charges its own commission fee.

Pick Your Binary Market

Multiple asset classes are tradable via binary option. Nadex offers trading in major indices such as the Dow 30 (Wall Street 30), the S&P 500 (US 500), Nasdaq 100 (US TECH 100), and Russell 2000 (US Smallcap 2000). Global indices for the United Kingdom (FTSE 100), Germany (Germany 40), China (China 50), and Japan (Japan 225) are also available.

Trades can be placed on forex pairs: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, AUD/USD, USD/CAD, GBP/JPY, USD/CHF, EUR/GBP, AUD/JPY, and USD/MXN.

Nadex offers commodity binary options related to the price of crude oil, natural gas, gold, and silver.

Trading news events are also possible with event binary options. Buy or sell options based on whether the Federal Reserve will increase or decrease rates or whether jobless claims and nonfarm payrolls will come in above or below consensus estimates.

Pick Your Option Time Frame

A trader may choose from Nadex binary options in the above asset classes that expire intraday, daily, or weekly.

Intraday options provide an opportunity for day traders to attain an established return, even in quiet market conditions, if they're correct in choosing the direction of the market over that time frame.

Daily options expire at the end of the trading day and are useful for day traders or those who are looking to hedge other stock, forex, or commodity holdings against that day's movements.

Weekly options expire at the end of the trading week and are thus traded by swing traders throughout the week. They're also traded by day traders as the options' expiry approaches on Friday afternoon.

Event-based contracts expire after the official news release associated with the event so all types of traders take positions well in advance of and right up to the expiry.

Trading Volatility

Any perceived volatility in the underlying market also tends to carry over to the pricing of binary options.

Will the EUR/USD be above 1.1815 with one and a half hours left until expiration while the spot EUR/USD currency pair trades at 1.1825? The spot EUR/USD may have very little expectation of movement and the cost to buy or sell a contract may be in the $90 range when there's a day with low volatility. The EUR/USD is already 10 pips in the money while the underlying market is expected to be flat so the likelihood that the buyer receives a $100 payout is high.

But the cost to buy or sell the contract will get pushed closer to $50 as the probability of the underlying market price staying over the 1.1815 strike is lower due to the potential for a larger market move if the EUR/USD moves around a lot in a volatile trading session.

Pros and Cons of Binary Options

Unlike the actual stock or forex markets where price gaps or slippage can occur, the risk of binary options is capped. It's not possible to lose more than the cost of the trade, including fees.

Better-than-average returns are also possible in very quiet markets. It's hard to profit if a stock index or forex pair is barely moving but the payout is known with a binary option. It will either settle at $100 or $0, making you $80 on your $20 investment or losing you $20, if you buy a binary option at $20. This is a 4:1 reward-to-risk ratio, an opportunity that's unlikely to be found in the actual market underlying the binary option.

The flip side of this is that your gain is always capped. The most a binary option can be worth is $100 no matter how much the stock or forex pair moves in your favor. Purchasing multiple options contracts is one way to potentially profit more from an expected price move.

Binary options are worth a maximum of $100 so this makes them accessible to traders even with limited trading capital. Traditional stock day trading limits don't apply. You can open a live account for free. There's no minimum deposit required.

Binary options are a derivative based on an underlying asset that you don't own. You're not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock.

- Risks are capped

- Better than average returns

- Payouts are known

- Gains are capped

- Derivative-base can be volatile

- Limited choice of binary options available in the U.S.

Are Binary Options Safe?

The Financial Industry Regulatory Authority (FINRA) warns that many of these options are fraudulent. FINRA says that it "regularly receives troubling calls" regarding them. It advises sticking with U.S. options if possible.

How Does a Bid and Ask Price Work?

The bid price represents the most an investor will pay for a determined number of shares at a set point in time. The ask price is the flip side. It refers to the seller and identifies the least it will accept. The bid price is almost always less. The difference between the two numbers is referred to as the "spread." The spread is considered to be an indication of liquidity.

What Is Slippage in the Forex Market?

Slippage occurs when a trade is executed at a price that's different from what was anticipated. A downward slip occurs when the executed price is less and an upward slip occurs when the opposite happens. The gap can be minimized by trading when market volatility is low.

The Bottom Line

Binary options are based on a yes or no proposition. Your profit and loss potential is determined by your buy or sale price and whether the option expires worth $100 or $0. Risk and reward are both capped and you can exit options at any time before expiry to lock in a profit or reduce a loss.

Binary options within the U.S. are traded via the Nadex and CBOE exchanges. Foreign companies soliciting U.S. residents to trade their form of binary options are usually operating illegally. Binary options trading has a low barrier to entry but it doesn't mean that it will be easy to make money with just because something is simple. There's always someone else on the other side of the trade who thinks they're correct and you're wrong.

Only trade with capital you can afford to lose, and trade a demo account to become completely comfortable with how binary options work before trading with real capital.